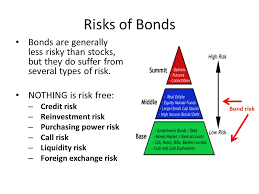

Risks associated with Bonds

Risks associated with Bonds: Bonds are a great way to maximize your hard earned income. They are generally considered low risk, specifically when compared with stocks. However, all bonds (debt bonds inclusive) do have some pitfalls which the investor must be aware of prior to making the decision.

Common risks associated with Investment in Bonds

- Interest Rate Risk and Bond Prices

Interest rates and bond prices are inversely proportional. This means that if the market interest rate falls, the price of the bonds in the trading increases. This is generally because as interest rates fall, investors try to scoop up as many bonds as they can to earn a higher return. With an increase in demand comes an increase in price as well.

- Inflation Risk

Inflation risk is the simplest to understand. A general rate of inflation is prevalent in all economies. Inflation risk simply refers to the risk that the return being earned through interest income on the bonds may not increase at the same rate as inflation is increasing. Inflation risk increases the longer a bond is held on to.

- Market Risk

The risk of a decline in the overall worth of the entire bond market is known as market risk. If this does happen, it will not matter what type of bonds you hold, as the overall price staggers.

- Credit Risk

When purchasing bonds from specific companies, their credit ratings over the course of several years as well as future prospects ought to be an important factor in the investors mind. This is because, if the credit rating of a company falls, this would cause the banks and other lending organizations to increase the rate of interest being charged. This increase would in turn lower the profits of the company, and thus lead to a lower return being earned.

- Liquidity Risk

Price almost always depends on the relationship between demand and supply. That being said, if there isn’t significant interest in the market place for a said debt bond, then the price would remain largely volatile and may even plummet. This would mean that the investor would have to sell at such a time that they would probably not even be able to recover the principal amount paid, much less accumulated interest.

For More Information & Videos Subscribe To Our YouTube Channel