What Are Predictions Of The Insurance Industry In 2018?

What Are Predictions Of The Insurance Industry In 2018?: What Are Predictions Of The Insurance Industry In 2018?

UK insurance industry offers a diverse range of services that are designed to benefit both individuals and corporations. The major sub-sectors of the insurance industry include:

- Medical Insurance

- Life Insurance

- Annuities and savings

- Business Insurance

- Property Insurance

- Vehicle Insurance

Role of Insurance in UK Economy

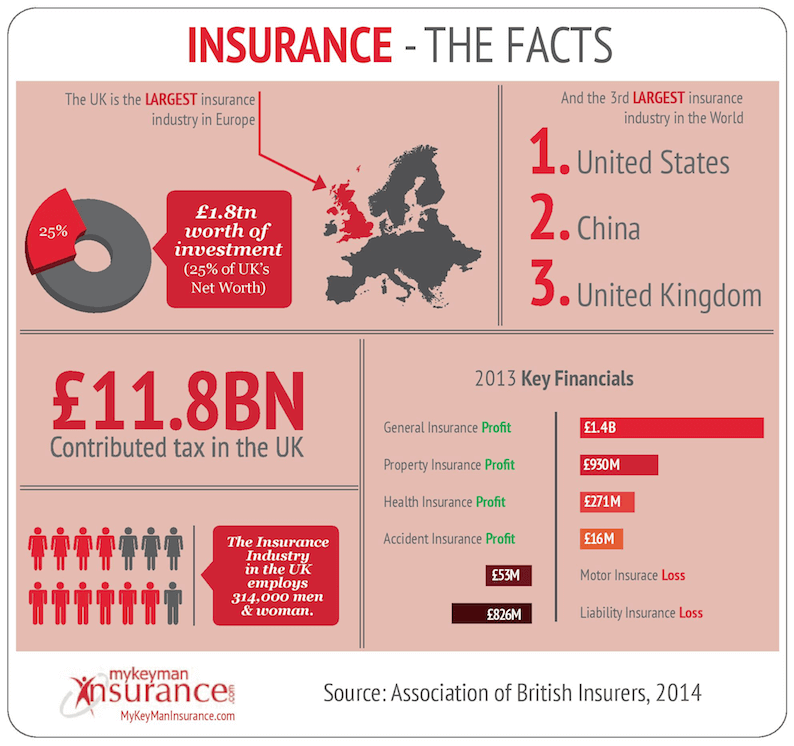

Insurance plays a central role in the UK economy. In fact, in terms of ranking it, it comes fourth in the largest economic sectors of the country, coming after banking, manufacturing and the public sector. Reports suggest that the assets managed by the insurance sector are above £1400 billion.

Predictions for 2018

2017 was a relatively tough year for insurance. However, conditions began to improve by the last quarter of the year with the introduction of new policies and reforms that helped bring back some of the insurance sectors lost glory.

Experts are hopeful that the positive trend will continue in 2018 as the reforms are favorable for the UK insurance industry and may help revive it. However, consumer spending has become somewhat restricted due to a high inflation rate standing at about 3%. This will have an impact especially on bigger luxury items such as vehicles.

- Motor insurance industry expected to turn around

In September, the proposed revised Ogden discount rate relating to personal injury claims improved prospects for the motor insurance industry. There were major concerns regarding vulnerable claimants receiving just compensation. It has also been proposed that before submitting reforms to the parliament, studies be undertaken to better comprehend whether the new legislation will be able to deliver fair compensation to claimants. The Civil Liability Bill will also reduce costs related to bodily injury, and this would further reduce premiums.

- Home insurance is not predicted to fare well

Escalating costs have rendered the home insurance market into a downhill trend. 2018 is predicted to be quite challenging for the home insurance market and this trend is forecasted to continue for a few years as there are no reforms in the horizon that would help boost this sector.

For More Information & Videos Subscribe To Our YouTube Channel