Difference Between Secured And Unsecured Debt!

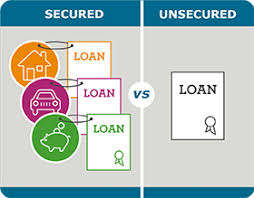

Difference Between Secured And Unsecured Debt!: If you are looking for a loan or any other financing method, you should know the two main categories they fall under; namely secured and unsecured debt. The most basic explanation of the difference between the two is the presence or absence of backing for the debt, i: e, collateral to be taken as security against non-repayment.

Today we will discuss what are secured debts while what are unsecured debts.

What Are Secured Debts?

When you take a secured debt, along with a promise to repay, you have to put up some sort of valuable asset as a security for the loan. This is to ensure that in the event of default by the borrower, the lender will receive the repayment of amount it had advanced to the borrower.

Most common categories of secured debt are mortgages and car loans; the item being financed is the collateral asset for the repayment financing. For example, when you take a car loan and if you fail to make timely payments, the lender has the right to acquire ownership of the vehicle. Similarly, when you as an individual or as a business take out a mortgage, the property in question becomes the collateral. If you default on the payments, the lender will seize the property and sell it to recover the funds owed.

What Are Unsecured Debts?

On the other hand, there is no collateral backing in unsecured debts. In the event of default by the borrower, the lender must initiate a lawsuit to retrieve what it is owed. The loans are issued based on the borrower’s credit worthiness and promise to repay only.

Lenders giving out unsecured debts usually charge a higher interest rate compared to secured loans. Moreover, the criterion for credit history of an individual and debt-to-income requirement is also typically stricter for these types of loans; only the most credible borrowers are issued such financing.

Common lenders of unsecured debts include loans from a bank, medical bills, some retail installment contracts such as gym memberships and the outstanding balances on credit cards.