Fintech Pioneer Online Credit-Lending Venture: The Altered Finance World

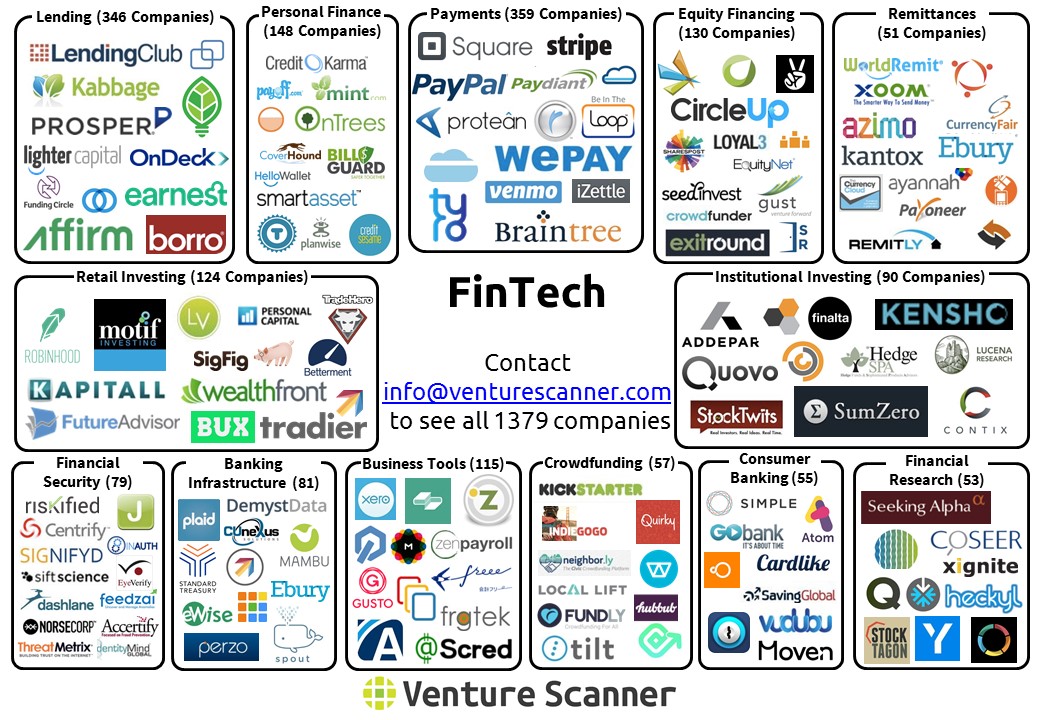

Fintech Pioneer Online Credit-Lending Venture: The Altered Finance World: Technology has significantly altered the world processes, making its mark on the new age as well as the finance world. Previously, financial transactions were handled with paper money, heavy, space occupying computers, and with a personal human touch but now, digital interfaces are used entirely. Moreover, the phenomenon of startups has contributed tremendously to the digitalization of financial activity. One such development is the online credit-lending venture by Fintech pioneer: taking credit card industry to another level.

Renaud Laplanche is the man behind taking a huge chunk of big banks’ credit card balances. He started his online lending venture ‘Lending Club’ initially, altering the way people gain credit. Now he has opened his new line of attack on the industry with his latest venture of consumer lending, ‘Upgrade’. It offers different lines of credit with the option of combining features of fixed-rate personal loans with the flexibility/availability of credit card borrowing.

Digital as well as Plastic

At first, the credit lines will be arranged over the internet only, but there are plans to give borrowers company specific physical cards eventually. This will resemble the workings of credit cards given out by any banks, allowing customers to draw money by simply swiping a piece of plastic. Financial forecasts deem this to be a frontal challenge to the credit card industry, which already faces intense competition.

The company’s objective is to develop and enhance online lending, bypassing banks and other intermediaries by connecting in-need borrowers with yield-generating investors. Upgrade’s line of credit provides customers the option of borrowing of up to $50,000 at a fixed rate and for a fixed term of one to five years. Customers have access to decreasing the amount of loan up to an extent and follow the time period they wish, making changes for repayments on the go. Resetting of the payment schedule is done automatically through real time changes via highly advanced technology employment.

This online credit-lending venture By Fintech pioneer is taking credit card industry to another level indeed. Effectively, increasing options for buyers, making a more transparent system that is more predictable, responsible and lowering costs compared to other credit lines.

For More Information & Videos Subscribe To Our YouTube Channel